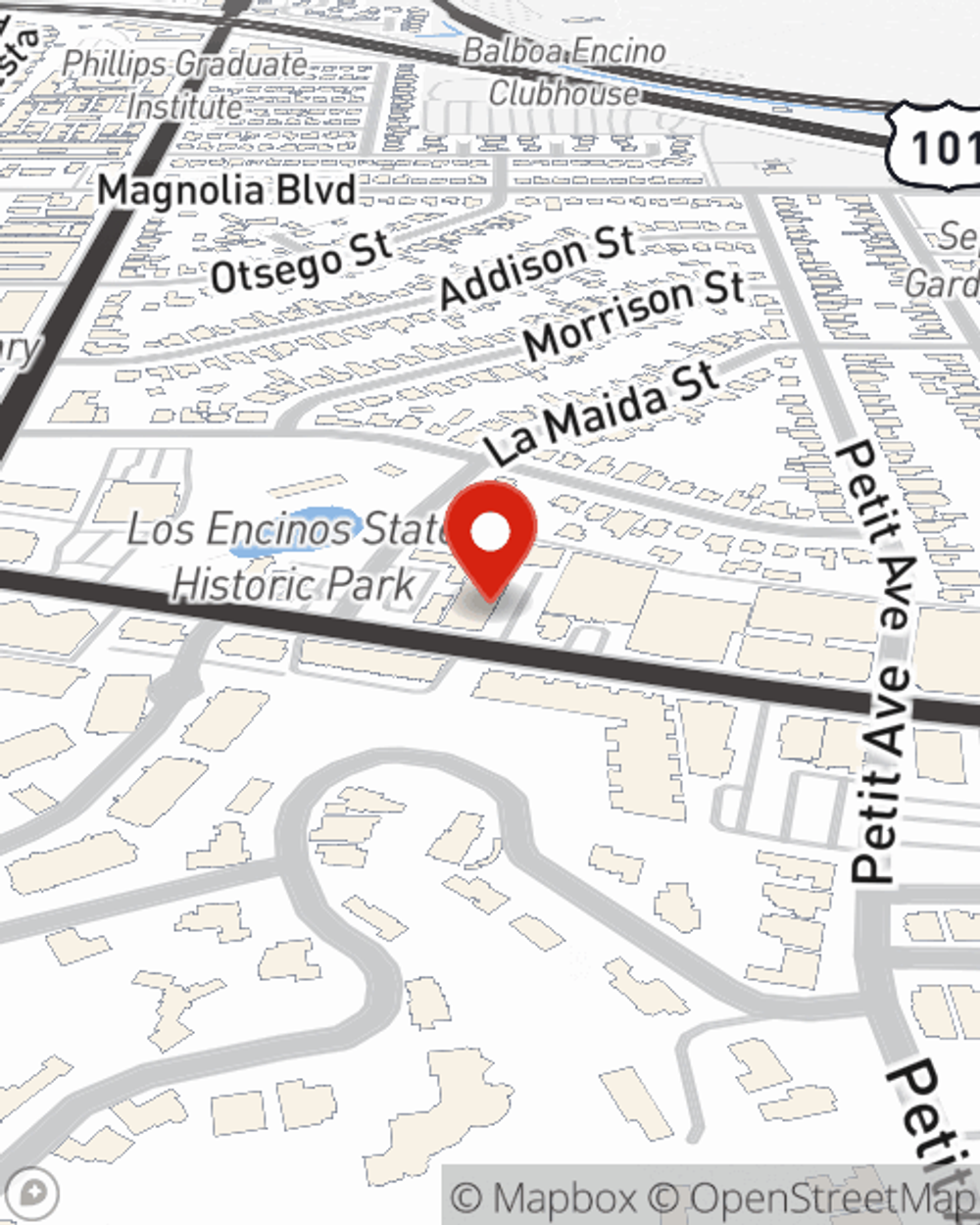

Condo Insurance in and around Encino

Here's why you need condo unitowners insurance

Cover your home, wisely

- Tarzana

- Calabasas

- Studio City

- Hidden Hills

- Sherman Oaks

- Winnetka

- Canoga Park

- Van Nuys

- Beverly Hills

- Reseda

- Woodland Hills

- Agoura Hills

- Los Angeles

- Brentwood

- Simi Valley

- Northridge

- Chatsworth

- Valley Village

- Pacific Palidades

- Ventura Blvd

- La Canada

- North Hollywood

- Lake Balboa

- Topanga

There’s No Place Like Home

Life happens.. Whether damage from weight of ice, vandalism, or other causes, State Farm has wonderful options to help you protect your condo and personal property inside against unpredictable circumstances.

Here's why you need condo unitowners insurance

Cover your home, wisely

Why Condo Owners In Encino Choose State Farm

Despite the possibility of the unexpected, the future looks bright when you have the terrific coverage that Condo Unitowners Insurance with State Farm provides. More than just protection for your townhome and personal property inside, you'll also want to check out bundling liability coverage, and more! Agent Sherwin Shafiee can help you build a policy based on your needs.

Visit State Farm Agent Sherwin Shafiee today to learn more about how a State Farm policy can help protect your townhome here in Encino, CA.

Have More Questions About Condo Unitowners Insurance?

Call Sherwin at (818) 849-5211 or visit our FAQ page.

Simple Insights®

Help control your home monitoring system with your smartphone

Help control your home monitoring system with your smartphone

The latest generation of smart home monitoring goes far beyond smoke detection and intrusion alerts.

Community and urban gardening

Community and urban gardening

Community and urban gardens are an excellent place for growing fresh food. Learn how to secure your garden plot and how to make the most of your space.

Sherwin Shafiee

State Farm® Insurance AgentSimple Insights®

Help control your home monitoring system with your smartphone

Help control your home monitoring system with your smartphone

The latest generation of smart home monitoring goes far beyond smoke detection and intrusion alerts.

Community and urban gardening

Community and urban gardening

Community and urban gardens are an excellent place for growing fresh food. Learn how to secure your garden plot and how to make the most of your space.